Transforming Firm Wide

Financial Crime Risk Assessments

Enjoy a 7-Day Free Trial

Struggling with Financial Crime Risk Assessments?

You’re Not Alone

Overcome this Key Challenge

Many firms find financial crime risk assessments a challenge—not because they don’t recognise their importance, but because traditional methods are often time-consuming, complex, and difficult to keep updated.

From regulatory expectations to evolve financial crime threats and static reporting, firms are battling to stay ahead of evolving threats. If your risk assessment feels more like a compliance burden than a strategic tool, it’s time to rethink your approach.

Regulatory Expectations

Information

Overload

Static & Inneficient

Reporting

The Need for

Continuous Updates

A Smarter Way to Assess Financial Crime Risks

LensIQ: An Intelligent, Continuous Risk Management Solution

Fast

Accurate

Granular

Dynamic

Features

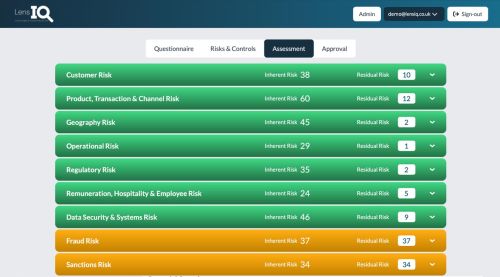

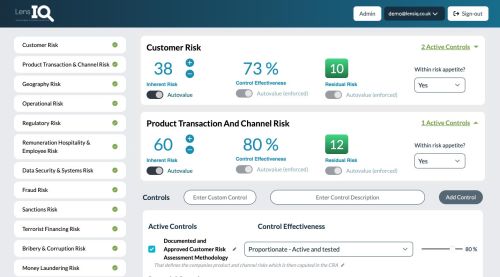

Internal Risk Analysis

Automatically identify relevant threats and risk indicators using real-time external intelligence.

Maintain a centralised risk register for your organisation, tailored by business unit, product, customer segment, and transaction type.

Control Effectiveness Evaluation

Assess controls at scale with a structured approach.

Maintain a comprehensive control library and map it to risk indicators.

Measure control effectiveness with data-driven insights.